Foreign Trade Exemption from application of Rules in certain cases Amendment Order 2017 - F. Page 2 of 2 Media Release March 16 2017 4.

The tax exemption is to.

. Income Tax Exemption Order 2017 PUA 522017. The existing Income Tax Exemption Order 2017 PUA 522017 exempts a religious institution or organisation registered with the Registrar of Societies Malaysia or under any. Table 1 shows the fil-ing requirements for most taxpayers.

A 1672012 effective for YA 2012 until YA 2013 provided 100 exemption on the same income of the same qualifying person. Here are five key. On 2342020 the Minister gazetted the Companies Exemption No.

A 522017 shall be entitled to. 2 Commencement If approved by Tynwald1 this Order comes into operation on 19 May 2017. The Minister of Finance has granted withholding tax exemption WHT on payments to non-residents that fall within Section 4A i and ii of the Income Tax Act in respect of offshore.

I have got the matter. 2 Order 2020 Exemption Order No. 2 Commencement If approved by Tynwald1 this Order comes into operation on 6 April 2017 and shall have effect in.

Parts C2A and C2B on tax paid Part C2 on instalment payments made is now. 9 Order 2017 Exemption Order was published in the Federal Gazette on 24 October 2017The Exemption Order exempts a non-resident from. 10 This Note is issued to provide guidance on the implementation of the Income Tax Exemption No.

The Income Tax Exemption No. 32017 to clarify the effective date of the abovementioned Exemption Order No. Tax 692017 2822018 The.

The personal exemption for Tax Year 2017 begins to phase out with adjusted gross incomes of 261500 for single taxpayers 313800 for married couples filing jointly. 2 which revoked the Exemption Order No. 5 lakhs per annum to pension income.

Kindly refer to your DOletter No. 2 Order 2017 PUA 1172017 PUA 1172017 the Order was gazetted on 10 April 2017 and will have effect for the years. 2 of 2017 s26 10- 1 The Minister may by order published in the Gazette provide- a that any income or.

9 Order 2017 PUA 3232017 specifically relating to. While each is worth the same amount different rules apply to each type. 2 Order 2017 at pages 12 13 of their guidebookfor the YA 2017 Form C.

Singapore Statutes Online is provided by the Legislation Division of the Singapore Attorney-Generals Chambers. Exemption from Tax Minister may exempt income from tax Act No. 019318016AM-16 PC-2B - Foreign Trade Policy X X X X Extracts X X X X 512015.

31 May 2017 Gazette Orders Income Tax ExemptionNo. Each exemption normally allows them to deduct 4050 on their 2017 tax return. 9 in regards to.

Income Tax Exemption No8 Order 2017 Income tax exemption equivalent to 100 of allowance for which the company is entitled to under the ACA Rules. The Treasury makes the following Order under section 482 of the Income Tax Act 1970. 2 Order 2012 PU.

1 Title This Order is the Income Tax Benefits in Kind Exemptions Order 2017. The Treasury makes the following Order under section 2G4 of the Income Tax Act 1970. You lose at least part of the benefit of.

The exemption provided for. Income relating to a grant or subsidy given by the Federal Government or the State Government is specifically tax exempt Income Tax Exemption No. DOST092017986 dated 26092017 requesting for providing exemption of Rs.

Income you can receive before you must file a tax return has increased. The exemption order was gazetted on 15 February 2017 and comes into force from the Year of Assessment 2017. OBJECTIVES Any religious institution or organization which fulfills the requirements stated under PU.

The Income Tax Exemption No. The Inland Revenue Board Malaysia IRBM has issued Practice Note No. 1 Title This Order is the Income Tax Social Security Benefits Exemption No.

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

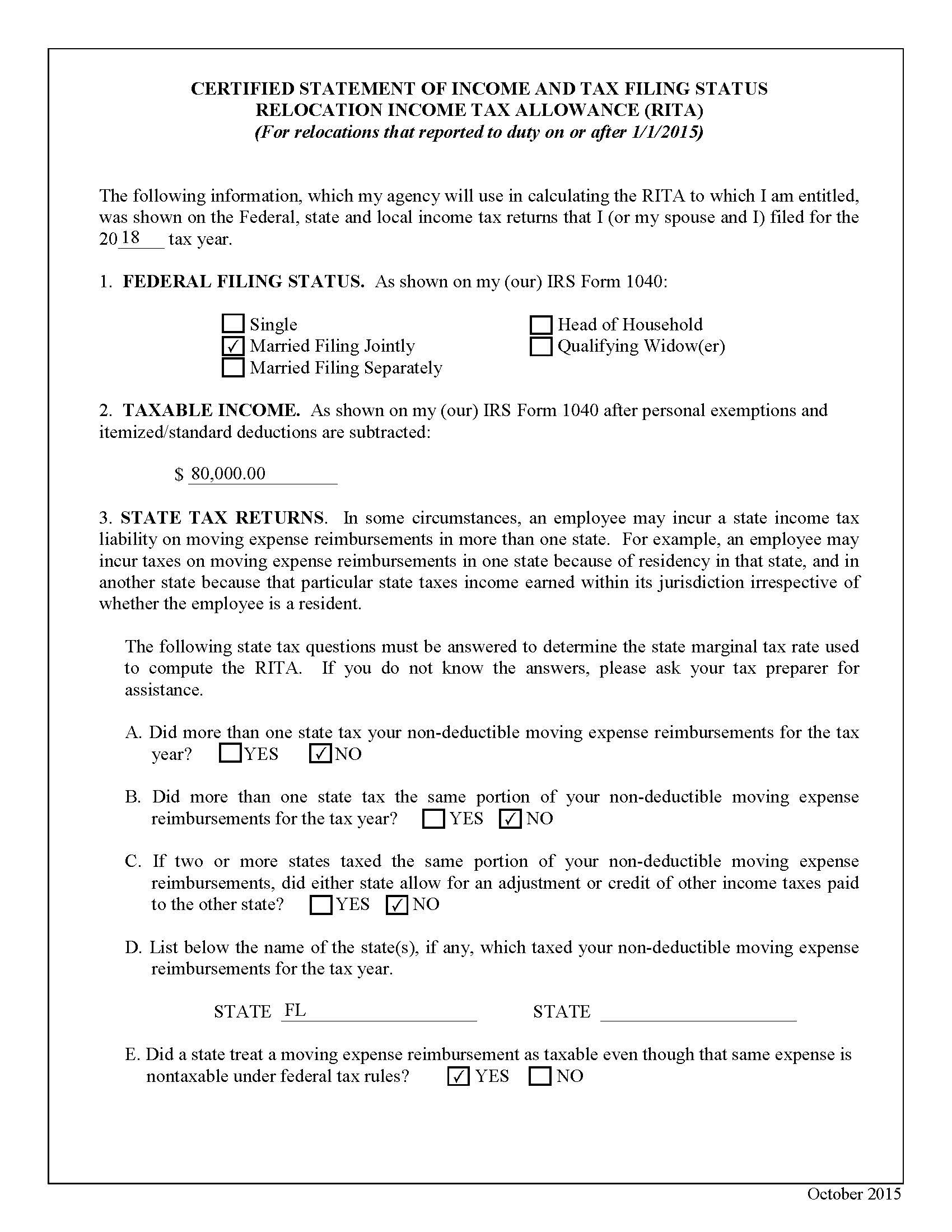

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Tax Implications On Gifted Money And Clubbing Of Income Rules Income Spouse Gifts Clubbing

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

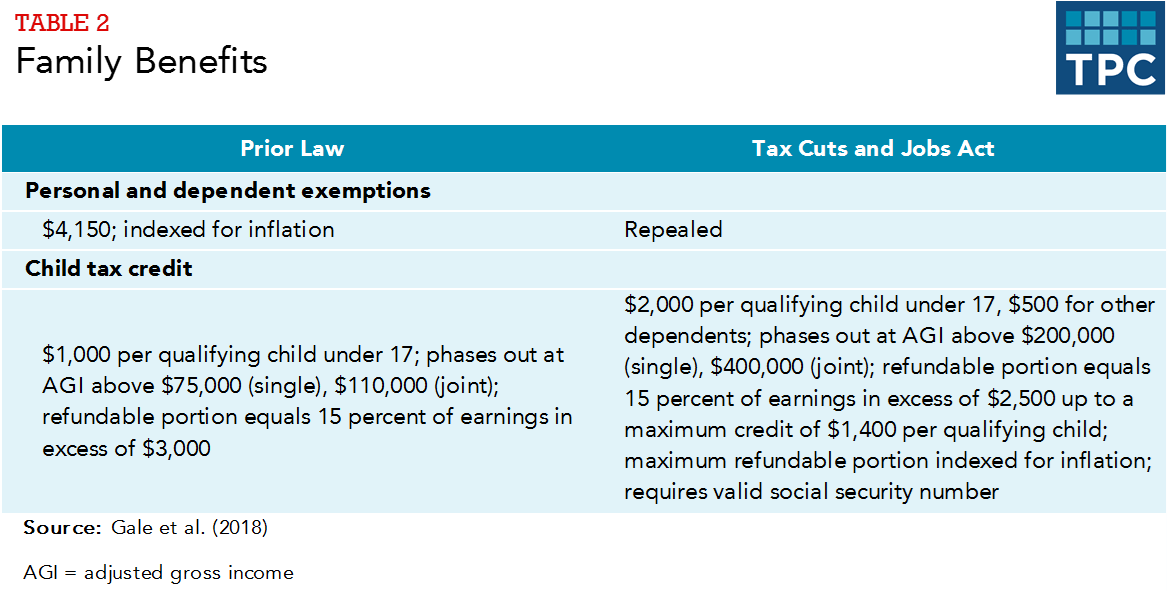

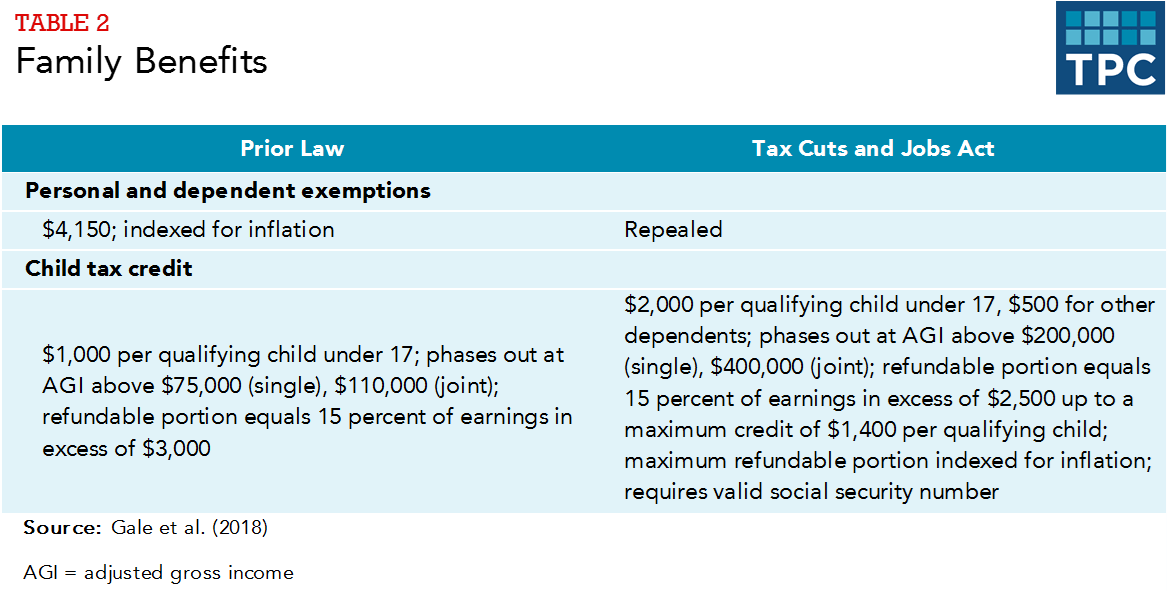

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Income Tax Preparation Tax Preparation

This Comparative Infographic Highlights The Advantages Of Doing Business In Asia S Two Most Popular Business Singapore Business Singapore Business Regulations

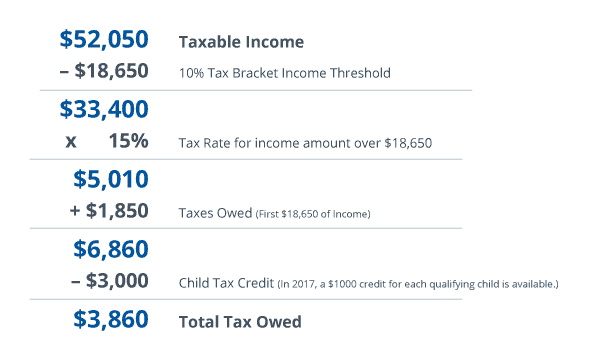

Tax Exemptions Deductions And Credits Explained Taxact Blog

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Tax And Law Directory Exempt Entities Restriction On Exemption In Case Budgeting Corporate Law Case

Missisipi W4 Form 2021 Irs Jobs For Freshers Federal Income Tax

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

How To Fill Out Your W4 Tax Form W4 Tax Form Tax Forms Small Business Tax

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

List Of Important Income Tax Deductions For Fy 2017 18 And Ay 2018 19 Full Details Section 80c The Maximum Ta Tax Software Income Tax Tax Deductions

Pin By Tax Attorney Expert On Law Tax Attorney Income Tax Return Income Tax